This week is all about the two-day meeting of the Federal Open Market Committee, which starts on Tuesday. The Fed will release a policy statement summary of economic projections and a press conference with Fed Chair Janet Yellen.

The US Federal Reserve begins its once-per-six-weeks policy meeting on Tuesday, with a statement to be issued by Chairwoman Janet Yellen on Wednesday at 2 pm EST. Expect lower volatility across most markets on Tuesday and Wednesday prior to the announcement, with a spike in volatility immediately after 2 pm. We cannot know exactly what will be announced on Wednesday, but the charts are positioning themselves for an important low to form across the precious metals complex coming into the meeting.

The markets are pricing in a near-zero chance of an interest rate hike on Wednesday, with roughly a 50% chance for a hike at the last meeting of the year in December.

Below we show the current dot-plot for interest rate expectations by the 16 members of the Federal Open Market Committee (FOMC), which gives a consensus estimate for what US short-term interest rates will average for each of the next two years and beyond.

Image A

For 2018, the consensus average is 2.00% – 2.25%, which would necessitate four more quarter-point interest rate hikes from the current target of 1.00% - 1.25%. This is the general expectation of the FOMC, although it is always subject to change based on market conditions.

Although there is expected to be no rate hike this Wednesday, the markets will be watching for a potentially more important source of information: language describing the Fed’s intentions to “normalize” its balance sheet going forward. That the Fed is set to normalize its balance sheet was first discussed at the policy meeting in June; however, we have received no tangible information as to how or when the Fed intends to engage in this normalization since.

As a reminder, gold sold off strongly on the day that the Fed announced its balance sheet normalization intentions, at the June 14 meeting.

“Normalization” – Say What?

Normalization is a euphemism used by central banks including the Fed: the term is used to describe the selling of bonds and other securities that the Fed has “purchased” since the credit crisis of 2007 – 2009.

Recall that these bonds – and all assets the Fed ever buys – are purchased with freshly created electronic money.

Whenever the Fed mentions purchasing anything, it is universally talking about printing money and debasing the currency – in other words, creating inflation.

This is rarely mentioned in mainstream financial publications, as the reality of the situation would be too appalling to discuss in such a forthcoming manner.

Yet, manipulating the prices of assets by purchasing them with newly-created money: this is the only tool that the Fed has ever had.

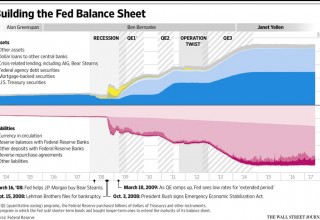

As a reminder of the unprecedented nature of the Fed’s balance sheet, the following chart is reprinted courtesy the Wall Street Journal, which shows the Fed’s holdings from 2004 through the present:

Image B

The most important point to observe is this: it took the Fed from its creation in 1913 through 2008 to accumulate (a.k.a. print) $1 trillion in assets, yet in just the last nine years alone it has printed over $3 trillion as its balance sheet has grown from $1 trillion to over $4 trillion. A second key to recall is that the bulk of the Fed’s purchases have gone toward US treasuries and US mortgages. Is it any wonder that long-term bond and mortgage rates are the lowest they have been since World War II?

The Fed has completely distorted the very fabric of the financial marketplace, and every piece of the system that sits on top of this distorted base stands to be affected if and when the Fed begins to normalize its balance sheet.

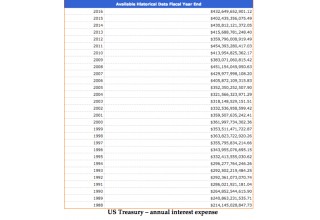

Image C

US Treasury – annual interest expense

Now consider that this near-record interest expense is accumulating when benchmark 10-year Treasury bonds are at their lowest rates in over two generations:

In other words, the government is paying record high interest when rates are at their lowest in modern history.

Can we imagine if treasury rates simply doubled, back to longer-term averages near 5.0%?

Such would mean that the US government’s interest expense would approach $1 trillion per year, assuming no further debt was added into the equation – and of course, new debt keeps being added to the pile each year.

What if 10-year yields returned to 7.5%, as they averaged for nearly 25 years from 1970 – 1995?

We must remember, when the Fed states that it intends to normalize its balance sheet, it is saying that it intends to sell its recently-purchased treasury bonds, and thus allow interest rates to rise.

Can the Fed realistically be expected to sell much of its balance sheet in the face of record US interest expense, and thus force the government to roll over its debt at higher and higher rates?

The practical answer is: no.

Most Only Know Falling Rates

Let us observe: anyone who has been investing in the western world since 1980 knows only falling interest rates as a macroeconomic backdrop. Assuming the average investor begins his or her career at age 22, this means that anyone born after 1958 knows only that interest rates keep falling, year after year.

A reversal in 37-years of falling interest rates is what the Fed is proposing.

We believe the Fed has backed itself into a corner, and it will have to renege on its normalization-speak. If it allows interest rates to rise significantly, the central bank will crush the funding mechanism of the US government. If it continues to suppress rates through newly-created money, it will begin to lose credibility as an independent and impartial body.

A loss of confidence in the very institution of central banking in the United States and likely spreading around the western world is the potential if the Fed is not careful.

Such will not happen overnight, but the Fed is walking a tight line between its own credibility and the ability of the United States government to fund its operations.

A Third Central Bank Failure?

Let us not forget: two central banks have already failed in the United States: the First Bank of the United States was dissolved in 1811, and the Second Bank of the United States did not receive a charter renewal in 1836.

Central banking was not present nor required in the United States during the great technological revolutions of the mid-1800’s through early 1900’s, including the implementation of the railroad, the light bulb, the telephone, radio, automobile, and air travel.

Could we be seeing the first warning signs that a third central bank has caught itself in an unsolvable situation and will follow a similar fate as the first two?

In an era of faltering faith in central-bank promises, gold stands to assume its historical function as the premier asset class of last resort – the only financial asset with no counterparty risk and which is nobody else’s liability. The history books are not written, but the fundamental data points and the quandary the Fed faces are there in plain sight for all to see.

For now, we watch to observe how the Fed handles its intentions for normalizing its balance sheet at this Wednesday’s meeting, and through the remainder of this year.

Christopher Aaron,

Bullion Exchanges Market Analyst

Christopher Aaron has been trading in the commodity and financial markets since the early 2000's. He began his career as an intelligence analyst for the Central Intelligence Agency, where he specialized in the creation and interpretation of pattern-of-life mapping in Afghanistan and Iraq.

Technical analysis shares many similarities with mapping: both are based on the observations of repeating and imbedded patterns in human nature.

His strategy of blending behavioral and technical analysis has helped him and his clients to identify both long-term market cycles and short-term opportunities for profit.

This article is provided as a third party analysis and does not necessarily matches views of Bullion Exchanges and should not be considered as financial advice in any way.

Share: