The Trump era is officially upon us. While we are politically-independent here and not officially supportive of either major American party, we believe Trump's election and inauguration last Friday is part of a larger worldwide trend in the emergence of "no confidence" votes against the mainstream political establishments.

Manifesting here in the United States, Trump’s tenure should be a particularly unique period of history to be an observer of, with reverberations to be felt around the world.

Case in point: Trump is the first President in modern history to openly criticize the Federal Reserve for its money-printing practices. Saying Fed chairwoman Janet Yellen should be “ashamed” of keeping interest rates too low (which requires printing money to buy short-dated bonds), accusing the Fed of creating a “false economy” and engaging in “political things” – this is unprecedented rhetoric coming from a presidential candidate during a major campaign.

The Chinese proverb says: “May you live in interesting times.” Indeed.

____

The Fed and the White House

The last president to openly criticize the Fed is believed to have been George H. W. Bush, who spoke about the central bank after his 1992 defeat. Ironically, Bush blamed the Fed for not printing enough money, saying: “I think that if the interest rates had been lowered more dramatically that I would have been re-elected President, because the [economic] recovery that we were in would have been more visible.”

Fast forward to last September, in which the relationship between the White House and the Fed over the preceding generation was perfectly illustrated by Hillary Clinton when she said: “You should not be commenting on Fed actions when you are either running for president or you are president.”

So now we have Trump who indeed seems comfortable commenting on Fed actions while running for president. Will he consider criticizing the central bank while actually in office?

Consider that Rebekah Mercer, daughter of billionaire hedge-fund CEO Robert Mercer, sat on the executive committee of Trump’s transition team. She is expected to play a key role in fostering Trump’s agenda during his presidency. Her father, Robert Mercer, in addition to being head of the famed Renaissance Technologies fund, was the chief backer of the Jackson Hole Summit in August 2015, a private financial symposium designed to stand in contrast to the Fed’s own conference held at the same time and place.

The principle themes of the Mercer-funded summit? The abolishment of the Federal Reserve and a return to the gold standard.

With the advisory and financial backing of billionaires with anti-Fed leanings, will Trump be the first president in modern history to question the seemingly omniscient central bank during his term?

And how would most Americans – who are still largely unaware that the US dollar is not backed by any tangible asset – respond to a president questioning the institution that issues our fiat currency?

Any significant move of assets into gold and silver by a substantial portion of the United States (or world) citizens would cause a price acceleration unlike anything witnessed thus far in our analysis.

This is why, even as we endeavor to profit from the shorter-term swings in price that occur, we always advocate that investors hold a certain portion of their assets in a core metals position, stored as far outside the banking system as reasonably possible.

And so as Trump begins his first full week in office, the first active president to openly criticize the central bank in modern history, we once again try to filter out the charged rhetoric that appears in the mainstream financial and political press and turn as always to the charts.

____

US Dollar Update

In a confounding example of either early-presidential double-talk, or perhaps a reference to the singular currency-devaluation policies of China, Mr. Trump – who spoke so harshly of Federal Reserve money-printing on the campaign trail – stated on Tuesday that the US dollar was “too strong”.

The result on Tuesday was to send the dollar back to 100.2 on the Dollar Index, down over 1% for the day against a basket of foreign currencies.

It is here that words from politicians can become misleading and we must focus on regular identification of key zones on the charts:

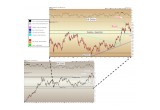

(See image A)

While the dollar has been weak over the last month, roughly corresponding to gold’s price rise from the December lows, this price action must still be viewed within the context of the breakout from the 2-year consolidation shown above between 92 and 100 on the index.

What we see thus far is simply a higher retest of the breakout zone.

We must respect the dollar breakout until proven otherwise, as it will tend to exert a negative drag on the precious metals in a typical trading environment.

We would consider the move in the dollar to have failed and thus to constitute an ominous long-term “false breakout” should the index close below 99.5, the spike low seen on December 8. Such a failed advance can typically lead to a strong reversal in the opposite direction.

Of course, the dollar and precious metals do not always move in opposite directions, and are sometimes highly correlated, a topic we will examine in more depth in the near future.

Happy investing this week, as we enter what should be a fascinating time to be a market observer if the new president does openly decide to criticize the Fed at any point during the next four years.

Share: