With the arrival of 2017 and another year in the record books, we take a look back at the closing data for 2016 and the major trends that impacted world markets.

For the year, across the major asset classes that we follow, we note the following 2016 ending performances:

(See image A)

Silver +15.6%

US Stocks (S&P 500) +9.5%

CRB Commodity Index +9.2%

Gold +8.6%

US Dollar +3.6%

US 30-Year Bonds -1.9%

In sum, despite the wild volatility, the precious metals put in respectable performances for the full year. These were the first gains for the metals on a yearly basis since 2012, which may indicate the beginning of a trend change.

“No Confidence” Goes Mainstream

The most significant theme that we perceived across the political landscape for 2016 was a vote of “no confidence” in the establishment regime. This growing voice of dissent was evident across three major political votes during the year and countless smaller movements worldwide.

First was the vote by British citizens to leave the EU in June. Dubbed “Brexit”, the vote came as a surprise to most major polling and media outlets. Central causes of the British dissent are believed to focus on issues of the economy, immigration, and sovereignty. And while a debate of those issues is beyond the scope of this publication, we can clearly observe the net result: the resignation of Prime Minster David Cameron and a major signal of dissatisfaction by UK residents toward the established political regime.

Second came Donald Trump’s election in November. Again largely dismissed by the mainstream media and polling organizations even up until the night of the election, the Trump victory came as a surprise to many. Trump will be the first US President to never hold prior political office. A significant message that we take away from the US election is that there are many more voters dissatisfied with the largely superficial “Republican/Democrat” divide than were previously believed to have existed. We did not officially endorse either candidate in the US election; yet clearly there is a growing sense of “no confidence” in the political system here in the United States, and many voters chose to voice that sentiment through a vote for Trump.

Last but not least, the Italian citizens delivered a third anti-establishment vote in rejecting the constitutional amendment proposed by then-Prime Minster Matteo Renzi in December. Largely perceived as supportive of large banks and corporations, Italians rejected the amendment by a final count of over 59%. Renzi resigned the next day.

The Seeds of a Precious Metals Bull Market Are Being Sown

Angst in the political system is currently being voiced through the democratic process.

However, it is only a matter of time before that distrust is voiced further through the monetary system. When individuals begin to wake up to the understanding that they are being robbed by the central banks — regardless of which party is voted in or out of office — they will then move to vote separately with their pocketbooks. And as gold spot price and silver spot price remain to this day the only assets completely outside the control of major governments or central banks, they remain the focal point of the growing movement against establishment political planning.

This theme of distrust by citizens toward their established political systems and central banks is a key component of our fundamental investment thesis for precious metals.

As of 2016, still relatively few citizens of the major democratic nations have any knowledge whatsoever regarding precious metals, and even fewer own the monetary assets. In our every day lives, how many people do we know who actually own precious metals in any form? I would urge readers to do some random polling at their workplace, at the coffee shop, at the grocery store, etc. If your experience is anything like mine, you will find that the metals are still barely even known as a legitimate asset class amongst average Americans.

Let us examine the silver market: current estimates show that only 2 billion ounces of silver exist in the investable form above ground.

What if 10% of the combined population of the United States, Great Britain, and Italy each wanted to buy 100 ounces of silver, a modest $1,600 at today’s prices?

Our back-of-the-envelope math shows that the combined population of those three countries is 450 million. So if 45 million citizens each wanted to buy 100 ounces of silver, the net result would be a new demand of 4.5 billion ounces.

The silver is not there. The result of such demand coming into such a small market would be that the price would be forced upward by many-fold, as the total dollar amount of metal available for purchase pales in comparison to the dollar supply floating around in individuals’ bank accounts.

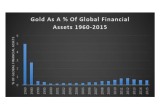

Even though the gold total market size is much larger than that of silver, we have data to show that even gold is widely under-owned to this day. Below we show gold as a percentage of global financial assets (data courtesy CPM).

(See image B)

At just under 0.7% of global assets, gold would need to rise four-fold to reach the relative peak set in 1980 when it first hit $850/oz and silver briefly touched $50. As silver remains below its 1980 peak to this day, its advance would likely be greater than gold on a percentage basis.

Momentum is gaining in opposition to the status quo political landscape, and 2016 saw evidence in three major western nations. Those voters are willing to step out and cast a ballot. It is only a matter of time before a critical mass makes the connection between the political world and the financial world and casts a further vote via a movement of assets into the precious metals market.

_____________________________________________________________________________________

Christopher Aaron,

Bullion Exchanges Market Analyst

Christopher Aaron has been trading in the commodity and financial markets since the early 2000's. He began his career as an intelligence analyst for the Central Intelligence Agency, where he specialized in the creation and interpretation of pattern-of- life mapping in Afghanistan and Iraq.

Technical analysis shares many similarities with mapping: both are based on the observations of repeating and imbedded patterns in human nature.

His strategy of blending behavioral and technical analysis has helped him and his clients to identify both long-term market cycles and short-term opportunities for profit.

This article is provided as a third party analysis and does not necessarily matches views of Bullion Exchanges and should not be considered as financial advice in any way.

Share: