This Fed decision is due Wednesday at 2 pm EST. Will gold be forming another important low in the surrounding days?

This week on Wednesday brings the long-awaited Federal Reserve meeting, where the US central bank is expected to raise interest rates by 0.25% to a new range of 1.25% - 1.50%. The probabilities for a rate hike at the coming meeting are exceptionally high, with the futures market pricing in a 90.2% chance of the single rate hike, with the dissenting 9.8% of traders favoring the probability of two rate hikes simultaneously. The chance of there being no rate hike whatsoever is effectively zero as priced by the market.

We will know the answer Wednesday at 2 pm EST.

Of course, the big question is: how will the price of gold respond?

Mainstream Myth

The mainstream media, including many well-respected outlets such as Bloomberg, continue to report the long-standing myth that rising interest rates are negative for precious metals. This week’s article at right illustrates the point again (note the red highlights):

Image A

We wonder where Bloomberg gets this data from – as both past and present examples show that rising Fed-controlled interest rates are decidedly positive for gold prices.

Examples of Past Rate Hike Cycles

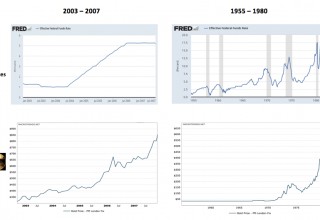

To the left, we examine the most recent Fed rate-hike cycle from 2003 – 2007, in which the central bank raised interest rates from 1.00% to 5.25% over this period. At the exact same time, gold prices rose from a low of $325 up through a peak of $850.

To the right we look at an even longer cycle – indeed, the largest and longest interest rate increase cycle in the post-Bretton Woods era. Note how it was rising interest rates, not falling interest rates, which set the backdrop for gold to break the controlled price of $35 per ounce and rise over 2,000% to the 1980 peak at $850:

Image B

Back to the Present

Bringing this back to the present example: thus far, since the first Fed rate hike in a decade which occurred in December 2015, gold has sequentially seen higher prices at each of the first four rate hikes.

The most recent increase of this cycle, which occurred on June 14, 2017, saw gold close at $1,260 in the futures market after the post-Fed trading witnessed a decline for the day on the idea that the Fed would begin balance sheet “normalization” by selling some of its Treasury holdings. Thus, gold must close above $1,260 by the end of the day on Wednesday for us to say that the pattern of higher interest rates and higher associated gold prices remain intact for the present cycle.

Let us update our Fed rate hike → gold cycle tracker, which shows three main components:

Top – US 3-month treasury yields, which have been spiking in the weeks prior to each Fed rate hike, thus serving as a leading indicator.

Black connecting arrows – showing the exact date of each Fed rate hike since 2015.

Bottom – the associated price of gold.

Image C

Note how each Fed rate hike thus far has been associated with a higher gold price, in complete contrast to the mainstream media myth that rising rates are bad for precious metals.

Further, note the strong rebounds that have occurred in the days immediately following each rate hike since 2015.

Takeaway on Gold Prices and the Fed

We have seen weakness in gold over the past several weeks. Many traders continue to sell gold, in anticipation of the myth that rising rates will be negative for precious metals.

Yet history shows that rate hikes are a positive backdrop for gold, and the present era thus far confirms this model.

This Fed decision is due Wednesday at 2 pm EST. Will gold be forming another important low in the surrounding days?

Christopher Aaron,

Bullion Exchanges Market Analyst

Christopher Aaron has been trading in the commodity and financial markets since the early 2000's. He began his career as an intelligence analyst for the Central Intelligence Agency, where he specialized in the creation and interpretation of pattern-of-life mapping in Afghanistan and Iraq.

Technical analysis shares many similarities with mapping: both are based on the observations of repeating and imbedded patterns in human nature.

His strategy of blending behavioral and technical analysis has helped him and his clients to identify both long-term market cycles and short-term opportunities for profit.

This article is provided as a third party analysis and does not necessarily matches views of Bullion Exchanges and should not be considered as financial advice in any way.

Share: