We continue to see a steady stream of evidence showing that high-powered money is entering the gold market in record numbers.

Gold is a tale of two markets. As Dickens famously starts:

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness.” - A Tale of Two Cities

Image A

Gold: on the one hand, we saw last week that US retail demand for physical gold has plunged to near-decade lows. The mainstream investor in the largest economy in the world is largely absent this market over the last two quarters.

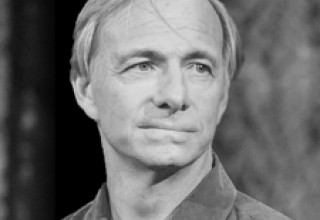

Yet, on the other hand, we continue to see a steady stream of evidence showing that high-powered money is entering the gold market in record numbers. We have already seen data showing that volume on the COMEX exchange has just reached its highest quarterly figure of all time (see article, October 16, 2017), and this week we see further evidence in the form of the quarterly 13F disclosure filed by Ray Dalio, founder of the largest hedge fund in the world, Bridgewater Associates. Specifically, Dalio has increased his investment in gold by over 400% through various ETFs in just the last quarter alone.

This should be a loud wake-up call to any smaller investor who may be growing impatient as gold progresses through its required long-term retest process: when the largest hedge fund in the world is making aggressive moves into gold, we should listen. Our technical data often shows us the “what” ahead of time – here now we get to see confirmation as to the “who”.

In one of his recent talks, Dalio specifically discussed gold: “We can also say that if… things go badly, it would seem that gold (more than other safe haven assets like the dollar, yen, and treasuries) would benefit, so if you don’t have 5% - 10% of your assets in gold as a hedge, we’d suggest that you relook at this.”

Ray Dalio, founder Bridgewater Associates, largest hedge fund in the world

And herein lies our thesis: if even 10% of the world’s population decided to move 5% – 10% of their assets into gold as Dalio recommends, the tiny metals market would be forced upward by a multiple of its current price level. This does not require an Armageddon scenario or hyperinflation – and indeed we hope to live in a world without such – but a simple shift in psychology away from the perceived safety of fiat currency by any sizeable portion of the world’s population is all that would be necessary.

We now see hints that “smart money” is positioning in the metals market, while many investors are still largely not participating. If you are reading this, you are therefore one of the contrarian-minded few.

We could not ask for a better setup, given the position gold finds itself in on the technical roadmap...

Gold Technical Analysis

For the week as a sum, gold was up by $22 or 1.8%, to close at $1,297 as of the final trade on the New York COMEX.

Friday’s $15 surge was certainly positive to witness, although from a technical standpoint we must remain open to the possibility that gold could continue to consolidate within or even slightly below recent ranges as it continues to retest its now-broken 6-year downtrend (magenta color)

Image C

Momentum indicators (RSI – top of chart) remain neutral, which leaves the possibility open for a sustained move to develop at any time. This is why it is not advised to let recent history be a guide for the near future: low volatility does not continue indefinitely. Yet the headlines which continue to emerge from the mainstream press regarding gold show us that popular sentiment is disinterested at this juncture due to the tightness of the recent trading action:

Nothing to see here – really?

Do not be fooled: smart money is now positioning.

To those reading: have a wonderful Thanksgiving holiday. I am grateful to be able to participate in this market with you – gold, the most ancient of markets, which is now seeing hints of new life coming into it.

Christopher Aaron,

Bullion Exchanges Market Analyst

Christopher Aaron has been trading in the commodity and financial markets since the early 2000's. He began his career as an intelligence analyst for the Central Intelligence Agency, where he specialized in the creation and interpretation of pattern-of-life mapping in Afghanistan and Iraq.

Technical analysis shares many similarities with mapping: both are based on the observations of repeating and imbedded patterns in human nature.

His strategy of blending behavioral and technical analysis has helped him and his clients to identify both long-term market cycles and short-term opportunities for profit.

This article is provided as a third party analysis and does not necessarily matches views of Bullion Exchanges and should not be considered as financial advice in any way.

Share: