A worldwide movement of capital into precious metals is what will account for the bull market that we believe is just in the beginning stages of developing.

Although we are primarily focused here on gold as priced in US dollars – as this remains the standard by which international traders and mining companies mark their assets – we remain cognizant that a worldwide movement of capital into precious metals is what will account for the bull market that we believe is just in the beginning stages of developing.

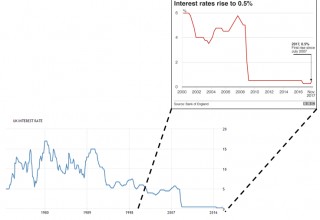

Thus we look elsewhere around the globe periodically. This past week the Bank of England under Governor Mark Carney raised interest rates by 0.25% to a new mark of 0.50%. While the fact that this was the first interest rate hike in the UK in 10 years is getting most of the mainstream attention, what is not being highlighted is that interest rates still remain at the lowest levels ever recorded in the British monetary system. Below we show the Bank of England prime rate from the abolished of the Bretton Woods gold standard in 1971 (when currencies were allowed to float freely versus the US dollar) through the present:

Image A

We must also note: not only have interest rates been held lower from 2007 through present than any time in modern history, but they have also remained lower than the rate the Bank of England set during World War II (2.0%). Can we truly fathom that England’s banking authorities deemed the nation’s economy to be in worse condition over the past 10 years than during the deadliest conflict in all of human history?

Such is the unprecedented nature of the time we live in.

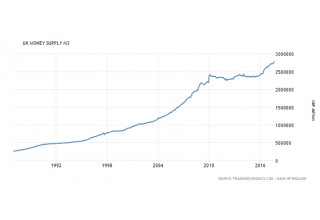

Those new to central banking should know that the controlling organization does not simply have a lever to pull to lower interest rates at will. No – central banks must continually print money to buy short-term bonds in order to keep interest rates suppressed below the level at which the market would naturally set. This is a principal reason why low-interest rates are inflationary: money is continually being created each month as the central banks hold rates down.

It should be no surprise then that M3 money supply in the UK – the broadest measure of the total quantity of British pounds in existence – has nearly doubled since 2007, and indeed, is up over 5-fold since 1992:

Image B

Trump Nominates Powell

Meanwhile on the other side of the Atlantic, President Trump this past week has finalized his nomination for new Federal Reserve chair: Jerome Powell. In recent weeks we covered how – if Powell is indeed confirmed – current chairwoman Yellen will have been “terminated” after the shortest tenure as Fed chair since G. William Miller presided over the highest inflation rate (14%) in US history in the late 1970’s.

What more, Powell was originally selected as a Fed governor under the Obama administration, thus showing us that when it comes to central banking, the Democrat /Republican divide exists in name only:

Janet Yellen “should be ashamed of herself” for creating “a false stock market” [by keeping interest rates low].

-Donald Trump, September 2016.

“I do like the low-interest rate policy… I have a lot of respect” [for Yellen].

-Donald Trump, July 2017.

The bottom line in central banking is: support primarily exists for Fed member banks at all costs. Everything else – consumer price inflation, unemployment, the value of the currency – comes secondarily.

Most major markets were little changed on Thursday / Friday on the news that Yellen will be replaced by Powell – indicating that the status quo of sufficient money-printing to maintain the solvency of member banks will remain in place even when the new chair takes office in February 2018.

Gold Price Update

Gold remains in the midst of its long-term downtrend retest zone. For the week, the historic store of wealth finished lower by a fraction, down 0.2% or $3 to finish at $1,269 as of the final trade on the New York COMEX on Friday afternoon. As precious metals investors, we must primarily focus on the main gold chart at all times, and nothing about the technical action over the past week has changed the fact that a 6-year downtrend (magenta line) is now in the process of retesting its breakout point.

Gold is attempting to establish a new trend. We must let this retesting process play out:

Image C

Christopher Aaron,

Bullion Exchanges Market Analyst

Christopher Aaron has been trading in the commodity and financial markets since the early 2000's. He began his career as an intelligence analyst for the Central Intelligence Agency, where he specialized in the creation and interpretation of pattern-of-life mapping in Afghanistan and Iraq.

Technical analysis shares many similarities with mapping: both are based on the observations of repeating and imbedded patterns in human nature.

His strategy of blending behavioral and technical analysis has helped him and his clients to identify both long-term market cycles and short-term opportunities for profit.

This article is provided as a third party analysis and does not necessarily matches views of Bullion Exchanges and should not be considered as financial advice in any way.

Share: