The US election is only eight days away, and the race has tightened over the last week. While Democratic candidate Hillary Clinton remains ahead in most polls, Republican candidate Donald Trump has recently taken the lead in key swing states such as Florida and Ohio.

Our general stance on the election is largely agnostic. We are not hugely fond of either candidate. Trump certainly would be a wild-card should he be elected, while Clinton would likely remain more tied to the existing political establishment, continuing the general trajectory of most of Obama’s initiatives of the last eight years.

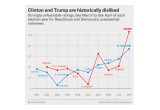

Yet from our viewpoint, it is not so much which candidate ends up winning the election, but rather the recent polls showing Americans’ negative sentiment toward both candidates which is most noteworthy.

(See image A)

Indeed, polls released this week show that for the first time ever, the majority of Americans view both candidates as “unfavorable”. (Note: the most recent percentages are now higher than even the chart above shows, at 52.4% unfavorable rating for Clinton and 59.1% for Trump.)

The level of distrust amongst Americans toward their politicians is at an all-time high.

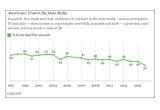

As a corollary, it is fascinating to note that Americans’ trust of the mass media is also now at multi-decade lows. The most recent 2016 poll from Gallup shows that the percentage of Americans who have “trust and confidence” in what they are told from mainstream news outlets has fallen to just 32%.

(See image B)

Something unprecedented is happening here both politically and culturally. This is at least one reason to hold some physical precious metals outside the banking system, regardless of what happens to the prices in the near term.

Markets and Elections

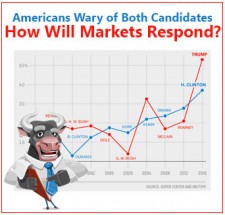

Historically speaking, since 1900 the data we have available does show that democratic Presidents correspond to better performances in the broad stock market over their terms in office, statistically higher than the performance seen with republican Presidents, as shown in the chart below.

(See image C)

However, correlation certainly does not equal causation.

For example, the data does not take into account the myriad of other factors that could have impacted the market averages over these years, such as central bank policies, debt accumulation due to war, or the bursting of market bubbles.

The data is also only expressed in nominal terms. When inflation-adjusted or priced in gold, the data would reveal quite different results.

We also know that there are delays as new policies work their way into an economy. Could higher stock market performances in certain years came as a result of policies implemented in prior administrations?

We cannot know any of this for certain. What we can do is observe the correlation and attempt to decipher what it will mean going forward: democrats do tend to see better stock market performances during their years in office.

The Election and Precious Metals

Turning our attention to precious metals and the election outcome, let us first consider the above-mentioned factor concerning higher stock prices under democratic Presidents. Because stocks and gold are often (but not always) counter-cyclical assets, broadly speaking we can surmise that gold and silver should be expected to perform better under a republican President.

We can observe that the two most significant bull markets in precious metals over the last 50 years began under two republican Presidents: the 1971 – 1980 advance of 2,400% in gold began under republican President Nixon, and the 2001 – 2011 advance of 760% in gold began under President Bush II.

Yet we must recall that the seeds of these precious metals bull markets were sown in the years prior to the republicans taking office, as unsustainable debt and currency depreciation during the prior years eventually forced a revaluation higher in the world’s ultimate monetary reserve: gold.

Again, just as we are hesitant to give sole credit to democrats for outperformance of the stock market, we cannot give sole credit to republicans for outperformance of the gold market.

The Brexit Effect

In the coming election, a Trump victory would clearly be a wild-card outcome, as it is not something seen likely in current electoral polls.

Essentially, we believe most markets are siding with the polls and “pricing in” a Clinton victory.

However, markets — and polls — are not always correct.

As we saw in Britain with the June Brexit decision in which polls prior to the vote still hinted that the UK would not leave the EU, markets can indeed be fooled.

Since a Clinton victory is already priced in, a Trump surprise win would be a shock for most major stock and currency markets.

As such, we contend that a surprise Trump victory might cause a spike in gold similar to the $110 intraday surge seen on June 24 as votes were being tallied in Britain. Yet this time, the gold spike, should the markets get this surprise, would come not from a falling British pound, but instead from a falling US dollar and/or US stock market.

How Will Americans Express Their Distrust?

No matter who ends up winning the American election on November 8, the most critical trend to follow is the general population that now distrusts both primary candidates and also the mainstream media.

To use the analogy of the popular game, there are not too many dominos that need to fall between the majority of Americans distrusting their government leaders, and at least a portion of those Americans deciding to vote with their wallets and to buy a modest allotment of gold or silver.

If you can’t trust the President, and you can’t trust the media, who can you trust?

It is estimated that still today, only 1% of Americans own any precious metals whatsoever.

Can we begin to fathom what would happen to prices if that percentage were to double, to say 2%? What if 10% of Americans wanted to have 10% of their net worth in gold and silver?

The fundamentals behind this sort of movement into the only asset outside of government control are as strong as they could possibly be. The key question remains timing. It is still early in this cycle. When will more people wake up?

Christopher Aaron,

Bullion Exchanges Market Analyst

Christopher Aaron has been trading in the commodity and financial markets since the early 2000’s. He began his career as an intelligence analyst for the Central Intelligence Agency, where he specialized in the creation and interpretation of pattern-of- life mapping in Afghanistan and Iraq.

Technical analysis shares many similarities with mapping: both are based on the observations of repeating and imbedded patterns in human nature.

His strategy of blending behavioral and technical analysis has helped him and his clients to identify both long-term market cycles and short-term opportunities for profit.

This article is provided as a third party analysis and does not necessarily matches views of Bullion Exchanges and should not be considered as financial advice in any way.

Share: