Category: Investments

The Hottest Coin of the Year

The New Silver Rectangular Circle

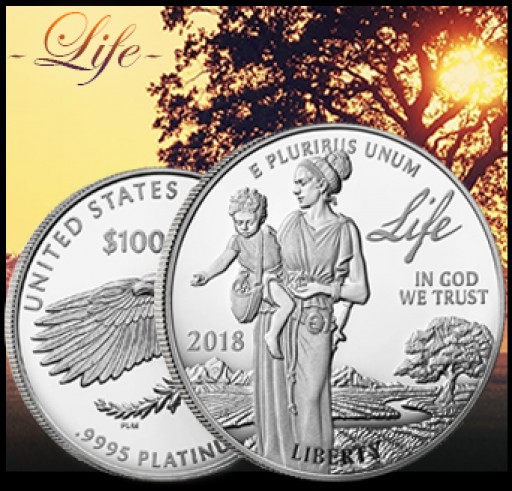

The first issue of the new 2018 Proof Platinum American Eagle (Life) in the Preamble to the Declaration of Independence Series has been released.

The technical roadmap for silver is mixed over the short-term but is setting up positively for late-2018.

We are on alert for what is going to be a significant breakout of gold priced in Japanese yen terms. It could have an impact on gold as priced in the USD.

The turning of the calendar gives us the opportunity to review gold price.

For the week, gold rose $21 or 1.7% to close at $1,279 as of the last trade on the New York COMEX on Friday afternoon. Let's take a look.

We anticipate gold has just formed an important price low in the $1,240 region last week. A period of consolidation with an upward bias is expected.

This Fed decision is due Wednesday at 2 pm EST. Will gold be forming another important low in the surrounding days?

Available for pre-order at Bullion Exchanges.

In November, gold price saw its single-highest ever monthly trading volume on the New York COMEX exchange.

To a large extent then, silver prices are going to be pushed or pulled in the general direction of the broader industrial commodities at this juncture.

We continue to see a steady stream of evidence showing that high-powered money is entering the gold market in record numbers.

The World Gold Council released this week show that gold demand for the third quarter came in at the lowest level since 2009.

A worldwide movement of capital into precious metals is what will account for the bull market that we believe is just in the beginning stages of developing.

Would it be better to sell gold or silver? There is no right or wrong answer - the questions lie with the individual investment goal.

Two important events in US financial field are coming within the next two weeks. Fed monetary policy and the new Fed chair.

We have a strong confluence of resistance levels within a tight range, this represents a high probability zone for the next gold target

After successfully released series of gold and silver medals in 2016, the KOMSCO offers the new 1/10 oz Chiwoo Cheonwang Gold Medal debuts with beautiful, colorized assay packaging (White, Black, Blue, and Red Assay cards).

The message of the market remains: gold is retesting the breakout from it's long-term 2011 - 2017 trendline while silver breaks lower.

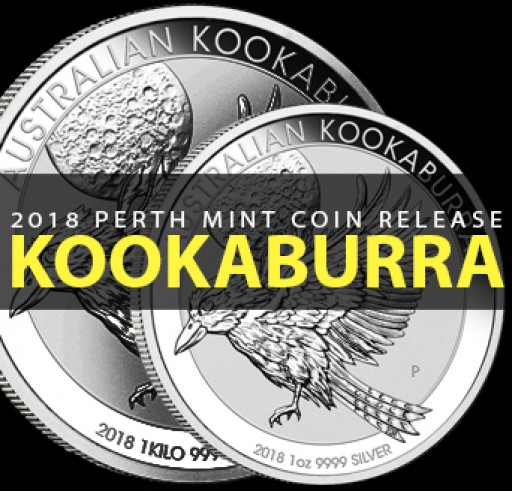

The Perth Mint presents the new 2018 Silver Australian Kookaburra coin.

Silver fell by 1.8% or $0.31 cents this week, close at $16.68 and it was the third weekly loss for silver in a row. What should we expect going forward?

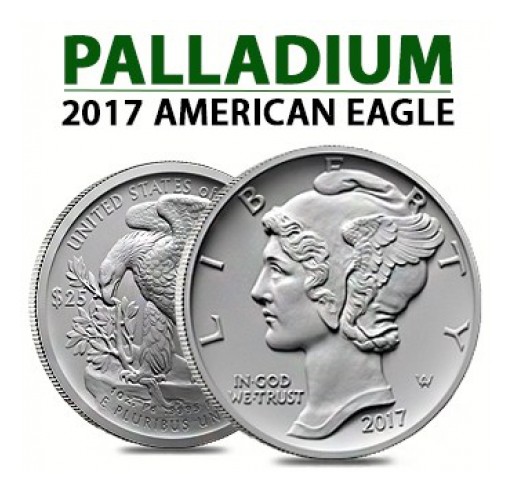

New upcoming release from US Mint.

For the week as a sum, gold closed lower by 2.1% or nearly $28 to finish at $1,291 as of the final trade on the New York COMEX on Friday afternoon.

Sept. 25th will see the release of the latest of the Queen's Beasts series, the highly-anticipated Unicorn of Scotland. This series is one of the newest available on the market, with its first release as recent as 2016. Honoring over 500 years of British monarchy and history, this release features an exciting new update to the design.

This week is all about the two-day meeting of the Federal Open Market Committee, which starts on Tuesday. The Fed will release a policy statement summary of economic projections and a press conference with Fed Chair Janet Yellen.

Exactly 16 years ago today, let us rewind back to the September 11, 2001, terrorist attacks to examine the price action in gold from a technical basis.

The most important news for precious metals investors was the price increase of gold in Japanese yen terms. Gold price broke above its 2016 high level.

Summer slow time of year for most of the financial markets is over.The strong seasonal period begins in August and continues through September.

Gold has now made its most legitimate breakout attempt - and furthermore, it has sustained the breakout for two full weeks.

You can see that yen and gold have been highly correlated since 2011, moving closely in tandem during both corrections and surges nearly six years.

How is JPY/USD related to gold? The similarity between these two charts is striking. Our article offers a direct comparison between JPY/USD and Gold.

It is important for investors to follow the valuation of the US dollar because when the dollar sees periods of decline investors seek safety in gold.

Gold and silver have recovered moderately over the past two weeks, which is certainly a positive sign that buyers remain ready to step in anytime.

Here is the technical perspective for gold for the short and intermediate timeframes, which shows that gold volatility begins lessening.

After silver "flash crash" last week, we believe over the long run, silver will eventually be moving higher.

The volatility in the gold market could increase massively throughout the second half of 2017 and into 2018. Gold is in the process of forming a long-term breakout.

The CRB index has recently broken below its 15-month support zone between 176 - 179, which had held since April 2016.

Gold price fell sharply following the Fed meeting on Wednesday, giving up $20. Investors consider the last FED news is seen as gold-negative.

The failed breakout and reversal back below the long-term declining trendline at $1,280 for gold this past week is a negative development for the entire precious metals complex. From a technical standpoint, it is exactly what we did not want to see as far as a market ready for a major advance.

We can see that the US bond market, at over $40 trillion in value, is much larger than the US stock market, which comes in at a little over $25 trillion.

The precious metal is now close enough to its key long-term 2011-2017 downtrend, and it could be another attempt to overcome the critical level.

The dollar has now negated all of the post-Trump rally, returning round-trip to the 97 level on the dollar index, a process which has taken six months.

Our market review shows that silver price finished higher last week (about 16,04 per ounce) and continues recovering over the intermediate-term.