Category: Financial News

The technical roadmap for silver is mixed over the short-term but is setting up positively for late-2018.

We are on alert for what is going to be a significant breakout of gold priced in Japanese yen terms. It could have an impact on gold as priced in the USD.

The turning of the calendar gives us the opportunity to review gold price.

For the week, gold rose $21 or 1.7% to close at $1,279 as of the last trade on the New York COMEX on Friday afternoon. Let's take a look.

We anticipate gold has just formed an important price low in the $1,240 region last week. A period of consolidation with an upward bias is expected.

This Fed decision is due Wednesday at 2 pm EST. Will gold be forming another important low in the surrounding days?

In November, gold price saw its single-highest ever monthly trading volume on the New York COMEX exchange.

To a large extent then, silver prices are going to be pushed or pulled in the general direction of the broader industrial commodities at this juncture.

We continue to see a steady stream of evidence showing that high-powered money is entering the gold market in record numbers.

The World Gold Council released this week show that gold demand for the third quarter came in at the lowest level since 2009.

A worldwide movement of capital into precious metals is what will account for the bull market that we believe is just in the beginning stages of developing.

Would it be better to sell gold or silver? There is no right or wrong answer - the questions lie with the individual investment goal.

Two important events in US financial field are coming within the next two weeks. Fed monetary policy and the new Fed chair.

We have a strong confluence of resistance levels within a tight range, this represents a high probability zone for the next gold target

The message of the market remains: gold is retesting the breakout from it's long-term 2011 - 2017 trendline while silver breaks lower.

Silver fell by 1.8% or $0.31 cents this week, close at $16.68 and it was the third weekly loss for silver in a row. What should we expect going forward?

For the week as a sum, gold closed lower by 2.1% or nearly $28 to finish at $1,291 as of the final trade on the New York COMEX on Friday afternoon.

This week is all about the two-day meeting of the Federal Open Market Committee, which starts on Tuesday. The Fed will release a policy statement summary of economic projections and a press conference with Fed Chair Janet Yellen.

Exactly 16 years ago today, let us rewind back to the September 11, 2001, terrorist attacks to examine the price action in gold from a technical basis.

The most important news for precious metals investors was the price increase of gold in Japanese yen terms. Gold price broke above its 2016 high level.

Summer slow time of year for most of the financial markets is over.The strong seasonal period begins in August and continues through September.

Gold has now made its most legitimate breakout attempt - and furthermore, it has sustained the breakout for two full weeks.

You can see that yen and gold have been highly correlated since 2011, moving closely in tandem during both corrections and surges nearly six years.

How is JPY/USD related to gold? The similarity between these two charts is striking. Our article offers a direct comparison between JPY/USD and Gold.

It is important for investors to follow the valuation of the US dollar because when the dollar sees periods of decline investors seek safety in gold.

Gold and silver have recovered moderately over the past two weeks, which is certainly a positive sign that buyers remain ready to step in anytime.

Here is the technical perspective for gold for the short and intermediate timeframes, which shows that gold volatility begins lessening.

The failed breakout and reversal back below the long-term declining trendline at $1,280 for gold this past week is a negative development for the entire precious metals complex. From a technical standpoint, it is exactly what we did not want to see as far as a market ready for a major advance.

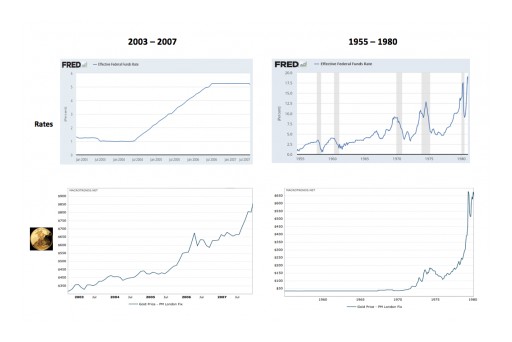

I've long stated that the mainstream media consistently gets the relationship between gold prices and short-term US interest rates wrong. The charts clearly show over both recent and historical cycles, rising interest rates have corresponded with rising gold prices - not the opposite, as erroneously stated by the majority of the press.

US Dollar must remain above 99.5 on the Index in order to avoid an extremely bearish reversal pattern.

Based on the recent analysis, we can conclude that gold itself still has further room to run over the intermediate timeframe.

Generally speaking, a falling US dollar will cause prices of commodities and international trade items to be more expensive as priced in the falling currency.

The Thompson Reuters/Jeffries Commodity Research Bureau Index (CRB Index) which is a weighted index of 19 commodities that trade on exchanges worldwide points that worldwide commodity prices are currently at lows not seen in over 40 years.

Two scenarios would change the validity of the basing action we are observing in the long-term cup formation of gold price. Gold was resilient over the last two weeks in holding up over the $1,200 level. But for the week, gold closed down $16 or 1.4% to finish at $1,188 as of the final trade on the New York COMEX on Friday.

The Trump era is officially upon us. While we are politically-independent here and not officially supportive of either major American party, we believe Trump's election and inauguration last Friday is part of a larger worldwide trend in the emergence of "no confidence" votes against the mainstream political establishments.

Gold was up nearly $23 last week to finish at $1,196 as of the final trade in New York on Friday. Such was the third weekly gain in a row for the historically-monetary metal.

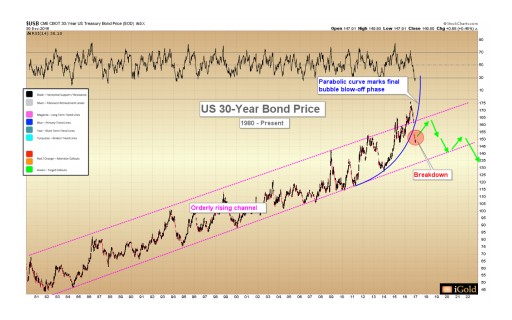

We have speculated often over the past year that long-dated US bonds were near the end of their unprecedented 36-year bull market. More evidence continues to show up that the trend has begun to shift and that what we have called the "bond bubble" of the last decade is set to begin deflating.

With the arrival of 2017 and another year in the record books, we take a look back at the closing data for 2016 and the major trends that impacted world markets.

2016 has been one of the most volatile years on record for gold: the best first-half performance in 40 years, followed by the ongoing retracement that has seen the bulk of the gains for the metal itself given back.

Given the potential for the pending low we are expecting across the precious metals in the next 2-3 months, it is important that we review gold priced in other major world currencies at this juncture.

The real American heritage 2017 American Eagles are now available for pre-order from Bullion Exchanges!

The prospect of the precious metals market could set an absolutely new path in December 2016 because of the new "Gold standard" in the Sharia law. The financial and personal lives of Muslims are guided by Sharia law, which doesn't allow to trade gold for the future value, interests or speculation.

Having fallen for five weeks straight since the Trump victory, gold this week broke through its final technical support of the 2016 advance, the 61.8% Fibonacci retracement of the entire surge, at $1,173, so we must now shift our focus toward identifying the next low that is set to come. For the week, gold fell 1.4% to close at $1,159 as of the final electronic trade in New York on Friday.

On Friday, Deutsche Bank agreed to settle privately for antitrust litigation brought against the German bank by traders and investors who accused the company of conspiring to fix gold prices at their expense.

The last piece in the renowned American Silver Eagle series will be released by the US Mint on December 1, 2016, at 12 noon ET. This splendid coin is an exclusive anniversary edition of the international best-selling coin program, bearing the unique smooth "30th Anniversary" lettered edge and burnished, matte-like finish - a true state-of-the-art collectible!

Let us be very clear: we are bullish on precious metals over the long term. Yet over the intermediate timeframe, the market is giving us signals that the long-term bottoms we are expecting to form may take a more complex path than was originally anticipated. We should stay nimble and be prepared for some twists and turns going forward.

In the wake of the Trump election, the US dollar has broken out higher from the two-year consolidation that we have been watching now for many months. Held between the 92 support level and the 100 resistance zone since the beginning of 2015, the dollar hit a high of 101.5 last week, decisively breaking through the aforementioned resistance.

The latest and highly awaited release in the 2016 Centennial coin series will be available at Bullion Exchanges in November! The US Mint celebrates 100 years of excellence in mintage by issuing the 3rd and last centennial rendition of another landmark coin - the 2016 Walking Liberty Half Dollar Centennial Gold Coin - available for sale on November 17, 2016, at 12 noon, Eastern Time.

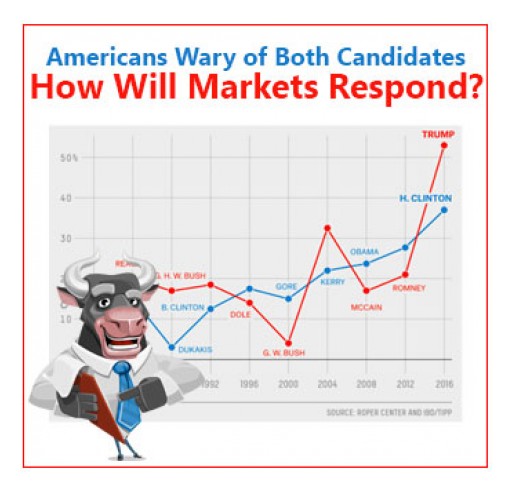

With no change announced to interest rate policy at the Federal Reserve meeting this week, the markets instead focused mostly on the upcoming US election.

The US election is only eight days away, and the race has tightened over the last week. While Democratic candidate Hillary Clinton remains ahead in most polls, Republican candidate Donald Trump has recently taken the lead in key swing states such as Florida and Ohio.